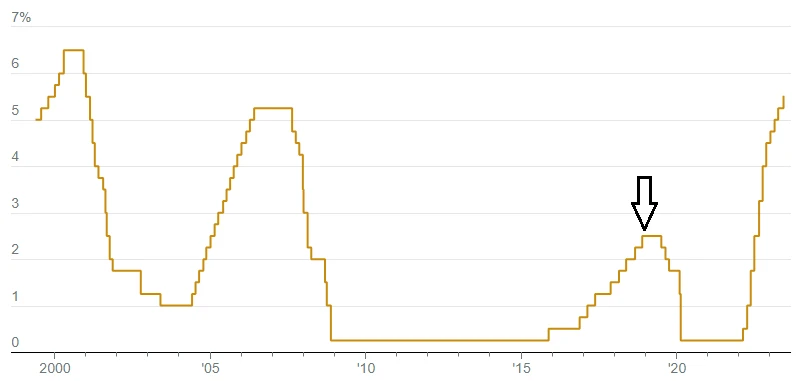

The Fed has added another quarter point to the federal funds interest rate, nudging it up towards 5.5%. This is bad news for individuals carrying variable rate debt, and those who are applying for a loan. It’s good news for me, because my retirement money is in local banks that are offering attractive CD interest rates.

This is the upside of inflation for risk-adverse retirees who are feeling the pinch of rising food prices. Finally, the financial sector isn’t skewed 100% in Wall Street’s favor and, whatta ya know, Wall Street is still doing fine.

For almost fifteen years, the easy money policy of the Fed gave Wall Street at least two advantages. First, money could be borrowed for free, tempting brokers to make risky speculative investments of the sort that contributed to the crisis of 2008. Second, there was a massive transfer of money into equities from commercial banks, because regular bank accounts paid nothing. Savings accounts are actually “losing accounts.”

The arrow in the graphic shows the last time I locked in an interest rate for my IRA CD’s. The pre-Covid rate of 2.5 percent wasn’t much, but it was a big bump up from what the rates had been, following the crisis of 2008. If the interest rate had stayed at zero, I would have given up the safety of bank CD’s for index funds. For now I can safely remain a contrarian, and a true financial conservative.